Founders, you must manage your cap table

Every time Accelerating Asia evaluates startups for our accelerator program there is at least one startup that checks all the boxes:

Great team

Great early traction

Large potential market

Obvious problem and solution matching

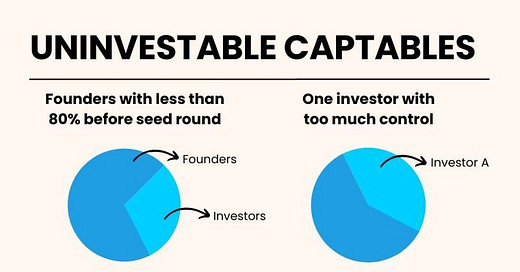

BUT! Their cap table is screwed up and we cannot invest as a result.

The most common thing we see is an early Angel investor who takes WAY too much equity, leaving little left for future investors. Especially in the emerging markets in which we operate this is unfortunately somewhat common. Often it’s a businessman (have never seen a woman do this to date) from another more traditional industry who begins to dabble in startup investing and puts in something like $50k for 40% of the company.

Why is this a problem?

Ownership of a startup needs to balance the following:

Founders need to maintain enough equity to be motivated to (over) spend their time to scale this into a positive exit event for the shareholders.

The company needs to have enough room to offer future investors more equity without leaving the founders with too little.

At each stage of a startup’s maturity and resulting fundraising structure there are generally accepted ranges of founder cap table ownership. Broadly speaking, founders should maintain the following ranges AFTER the fundraising round:

Pre-Seed: Founders should maintain at least 80%, ideally more. This usually means raising an Angel round of 10-15% of the company’s valuation at this time. An example could be raising $100k at $1 million post-money valuation.

Seed: Founders should maintain at least 60%, ideally 75%+. Sometimes the Seed round will be led by an institutional investor, which usually means a larger round size and larger dilution. An example could be raising $1 million at a $5 million post-money valuation.

Series A: Series A is the first time it is acceptable for the founder’s stake to dip below 50% ownership. When you raise an institutional Seed round followed by a Series A round, you’ll usually also have an ESOP built into one or both of those rounds and the total dilution can be fairly large at this point. A typical Series A could be $5 million on $25 million post-money valuation with a 15% ESOP pool.

The farther you fall below these ranges the more difficult it will be to raise future funds, especially from institutional investors.

Series B+: There is less standardization as you increase your maturity and transactions become more customized.

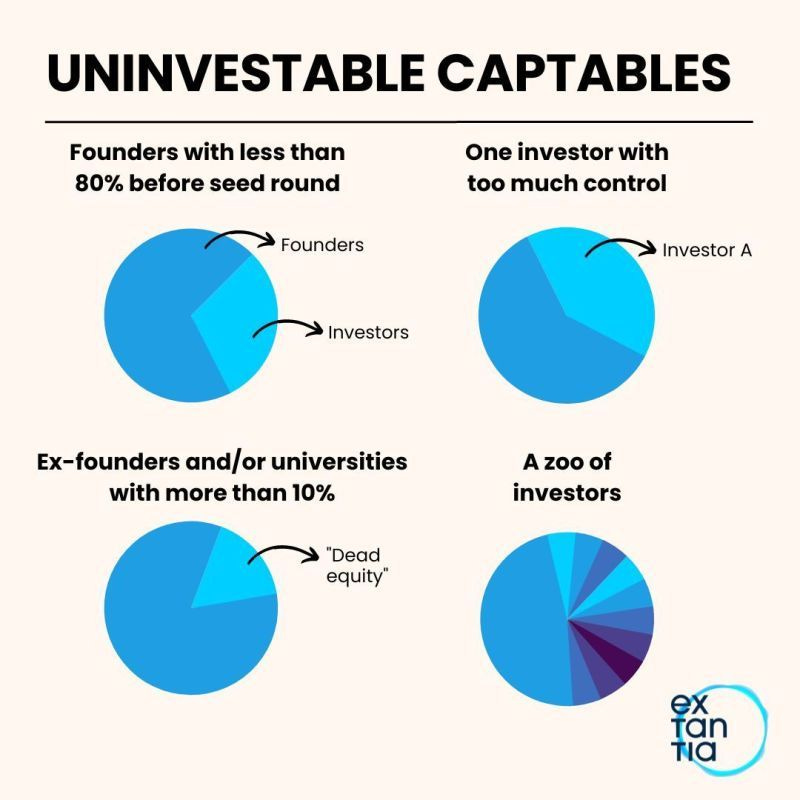

Another problem is having too many investors. This is more of a bureacratic problem. In order to proceed with some company plans you will need shareholders to sign off on them. This includes issuing more shares for an investment round.

As a real example, when my startup raised a bridge round, one of our small investors had died! It took weeks of back and forth with their heirs to figure out who could legally sign on their behalf (and of course we had to be very sensitive about the situation) while we were running low on cash…

How to solve this? No, not solve death, the other thing…

You can either be fairly strict with your minimum acceptable check size and/or create a syndicate pool for smaller investors, whereby there will be only one entity (and authorized signer) listed on the cap table for all of the smaller investors. If you’re in Asia you can check out our portfolio company Auptimate which helps startups manage syndicates.

Generally, if you’re raising $100k I recommend asking for min check size of $25k. If you must go lower on the first check or two to get things going that’s ok, but if you raise $100k and already have 10 investors+ that’s going to start to be a problem going forwards…

The last thing we’ll cover is “dead equity”. Dead equity is equity of previous stakeholders who have left, or in some cases a university or other company that is not directly involved in the business. Often, this is a cofounder who has left. Dead equity can wreck your startup so founders should ALWAYS have employment agreements with vesting schedules to protect against this.

If you either didn’t have a vesting schedule or the founder leaves after vesting is complete then you MUST negotiate an exit where their resulting equity is no more than 10% of the cap table and ideally as close to zero as possible.

And if you’ve already found yourself in one of these situations try to renegotiate things ASAP else your startup will be unlikely to raise capital. In some cases, if you find investors who like your business they may offer to help with these conversations (we have done this successfully a number of times, but cannot always get the investors to budge).